Money Art |October 2013 USA market view

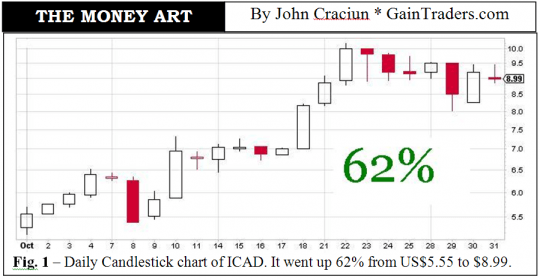

STOCKS. In the 1-month category, the best three stocks are ICAD @ 62%, EDMC @ 60% and NYNY @ 59%.

A stock trading on NasdaqCM, ICAD belongs to the Technology sector, Technical & System Software industry. With 310 employees, this New Hampshire-based, USA company provides image analysis, workflow solutions and radiation therapy which enable healthcare professionals and radiologists to identify pathologies and pinpoint cancer earlier.

The stock price went up because management released good Q3 results catching the attention of analysts who gave the company a positive outlook for the long term.

The top three stocks in the 3-month category are DQ @ 213%, GENT @ 186% and CSUN @ 155%.

In the YTD category the top three stocks are AAMC @ 680%, SPCB @ 656% and CSIQ @ 576%.

The best three stocks in the 12-month category are AAMC @ 4,165%, ACAD @ 901% and CSIQ @ 788%.

Three stocks with the biggest 1-month decline are PVG @ –53%, AMRN @ –74% and ARIA @ –88%.

In the “What’s hot, what’s not” category, the five hottest stocks are GENT, SHOO, CSII, BIOA and ZLTQ; the five least hot stocks are CFNL, BSBR, ITRI, TCK and ABCB.

SECTORS. 158 industry sectors out of 182 are in green territory.

The top three winners are Oil – Refining and Marketing, REIT- Equity Trust Retail and ETFs – Real Estate. The three bottom sectors are Biofuels, Communications Infrastructure and Other Alternative Energy.

MUTUAL FUNDS. The top performers this month are Blackrock Aggressive Growth Prepared @ 24%, Mour Tactical Flex Fund @ 15% and three of the Dreyfus India Funds @ 14%.

EXCHANGE TRADED FUNDS. The best three ETFs this month are G-X FTSE Greece 20 ETF @ 18%, Egypt Index ETF Market Vectors @ 12% and Italy Index MSCI iShares @ 11%.

FUTURES. The top contracts are: (Currencies) Australian Dollar @ 1.16%, (Energies) Ethanol @ 2.41%, (Financials) Ultra T-bond @ 1.59%, (Grains) Oats @ 5.16%, (Indices) E-mini NASDAQ @ 4.18%, (Meats) Milk @ 5.13%, (Metals) Platinum @ 5.04% and (Softs) Lumber @ 6.67%.

INDEXES. The best three indexes are S&P Telecommunication Services @ 7.35%, S&P Consumer Staples @ 6.13% and DOW Transportations @ 5.97%.

DOW Jones Industrial Average finished up @ 2.75% this month.

*

Relevant in October were titles like: “Default would be catastrophic: Erskine Bowles”, “More workers are ‘close to breaking point’”, “This is the next sub-prime crisis: Jim Rickards”, “Obamacare must be stopped: Stockman”, “Goldman: shutdown may continue even after Congress raises debt ceiling”, “When will the next US recession come?”, “Buffett reaps $10 billion from crisis investments”, “Plunge in shares coming in early 2014: SocGen”, “Carter: middle class today resembles past’s poor”, “Gold bull: 20% rally coming for bullion”, “US created 90% of world’s new millionaires”, “Stocks fast tracked to profit after Gov’t shutdown: Belski”, “The President has become too powerful: Jack Welch”, “’Calamitous consequences’ ahead if we go over debt cliff: Keating”, “Social security increase among lowest in decades”, “The most important skill of the 21st century”, “Gas prices could dip below $3 by year-end: Lutz”, “Budget impasse ‘a wash’ for the markets: Shiller”, “Buffett: debt limit is ‘weapon of mass destruction’”, “USA dominance set to diminish: ex WTO chief”, “Washington becomes the biggest risk to the US economy”, “Income inequality is the enemy of economic growth: Robert Reich”, “Google shares top $1,000: time to buy or sell?”, “6 million youths with no school or work”, “De-crowning the dollar, and the ‘collapse’ ahead”, “Dollar pain may spell further gains for gold”, “US SEC to release long-awaited “crowdfunding” rule”, “The next 10% correction could be 5 years away”, “Fragile five: the new focus of currency wars”, “Athlete IPO tests limits of investing morality”, “Gold may stumble towards $1,400”, “DOW could rise 10% or more in 2014: Siegel”, “S&P500 closes at record on Fed expectations (Oct. 28)”, “US home prices rise the fastest since 2006”, “Another housing bubble? Maybe not in our lifetime: Shiller”, “How Americans will adapt to lower living standards”, “Climate change puts one third of global economy at risk”, “Why best and brightest are turning against Wall St.”, “Bull market is only half over, but expect pullback: Hank Smith”, “Two key indicators that just guaranteed a year-end rally”, which are self-explanatory.

Recent Comments