Cyprus News | The Money Art – 2

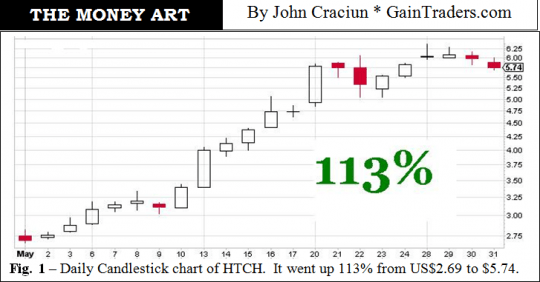

STOCKS. In the 1-month category, the best three stocks are HTCH @ 113%, TROVW @ 89% and TSLA @ 83%.

A stock trading on NasdaqGS, HTCH belongs to the Technology sector, Data Storage Devices industry. With 2,060 employees, this Minnesota-based, USA company engages in the research, design, development, manufacture and supply of suspension assemblies for hard disk drives.

The stock price went up because of high demand for hard disk drives, intensive insider buying and favorable analyst coverage.

The top three stocks in the 3-month category are TSLA @ 182%, MNKD @ 143% and AEGR @ 132%.

In the YTD category the top three stocks are OSBC @ 368%, SPWR @ 243% and HGSH @ 229%.

The best three stocks in the 12-month category are HGSH @ 1,188%, ACAD @ 974% and TWO.W @ 715%.

Three stocks with the biggest 1-month decline are WEBM @ –30%, OIB.C @ –31% and ALVR @ –38%.

In the “What’s hot, what’s not” category, the five hottest stocks are VRML, AFFY, LAS, DANG and AEGR; the five least hot stocks are WBK, MTL, GOL, ICA and UNXL.

SECTORS. 164 industry sectors out of 182 are in green territory.

The top three winners are Electronics – Semiconductors, Solar and Computer – Storage devices. The three bottom sectors are Industrial scientific, Utility – Electric power and Finance – Investment.

MUTUAL FUNDS. The top performers this month are the Fairholme Focused Income Fund and Footprints Discover Value Fund Cl @ 18%, Firsthand Alternative energy Fund and two of the Banks Ultrasector Profunds @ 16%, and Biondo Focus Fund @ 14%.

EXCHANGE TRADED FUNDS. The best three ETFs this month are Global Carbon ETN @ 28%, US Treasury Long Bond @ 18% and SPDR S&P Semiconductor @ 11%.

FUTURES. The top contracts are: (Currencies) US Dollar Index @ 2.32%, (Energies) Ethanol @ 6.17%, (Financials) 30-day Fed Funds @ 0.02%, (Grains) Soybean Meal @ 10.58%, (Indices) Russell 2000 Mini @ 6.74%, (Meats) Lean Hogs @ 0.94%, (Metals) Palladium @ 9.77% and (Softs) Orange juice @ 8.88%.

INDEXES. The best three indexes are CBOE Volatility Index @ 12.49%, S&P Financials @ 7.03% and S&P Smallcap 600 @ 6.63%.

DOW Jones Industrial Average finished up @ 2.82% this month.

*

Relevant in May were titles like: “After record highs, ‘sell in May’ could be right”, “Why the Treasury market is headed for collapse”, “Businesses cut jobs as sequester hits”, “Roubini: Fed risking sequel to 2008 crisis”, “S&P500 hits new all-time high, NASDAQ 1% (May 2)”, “Stocks hit all-time highs: S&P500 breaks new record above 1,600, DOW above 15,000 (May 3)”, “Munger: Bankers are like ‘heroin addicts’”, “Warren Buffett: stocks will go a ‘lot higher’”, “Only 150 of 3,500 US colleges are worth the investment: Bennett”, “DOW ends above 15,000 for the first time, S&P closes at record (May 7)”, “Roubini: No stock bubble but crash may come”, “DOW’s hitting new highs – but are you?”, “Unemployment could ‘scar’ entire generation: ILO”, “The Internet kills more jobs than it creates: Jaron Lanier”, “Roubini: Bubble in stock to burst in 2 years”, “Gold fundamentals have never been better: Schiff”, “US economy throws wrench in currency markets”, “US income gap may have reached turning point”, “’We are living in a tech depression: Andreessen”, “Record stock market rally leaving half of Americans behind”, “Microsoft’s next-gen Xbox will change the world: Pachter”, “DOW, S&P500 hit new highs; investors confident in rally (May 15)”, “US Treasury takes step to avoid hitting debt limit”, “S&P500 won’t hit 2,500 until 2017: strategist”, “US bull market shows signs of wear”, “Gen X on track to be worse off than boomers in retirement”, “Jim Rogers: the commodities bull market is still on”, “Copper and S&P – which has it wrong?”, “Why Fannie Mae shot up 400% in 3 months”, “Gold rallied for years on misunderstanding’”, “Buy the dip, we’re going to DOW 16,000, says Schoenberger (May 24)”, “Hot trend in automobiles: not owning one”, “No time off? Welcome to the ‘no-vacation nation’”, “Big Banks still write the rules: former Inspector General of Bank bailout”, “DOW 28,000 possible in six years: Blackrock’s Fink”, “Austerity bites into US growth”, which are self-explanatory.

Recent Comments